Uncertainty Assessments of Wind Resource and Energy Yield

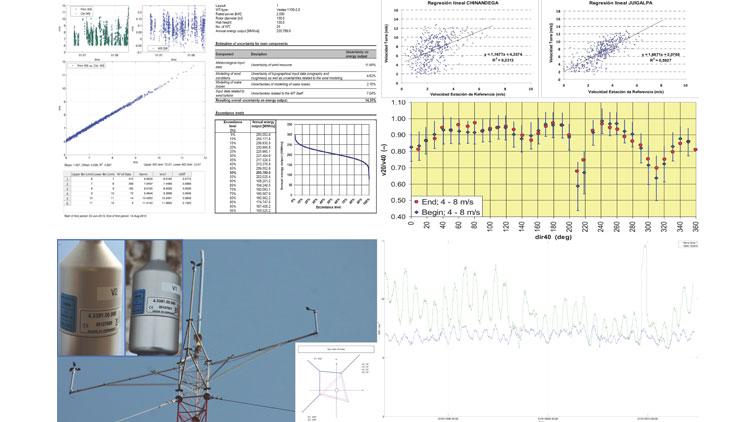

Accredited as testing laboratory following ISO / IEC 17025:2005 for wind resource and energy yield assessment, including uncertainty assessment conform to ISO / IEC 61400-12-1, MEASNET and FGW standards

Bankable determination of uncertainties is a key component for project financing and the optimization of financing conditions

Our Clients, especially banks, investors and project developers, entirely rely on our expert opinions and bankable reports. Our assignments are presented to the financing banks and to wind turbine manufacturers, in order to negotiate their involvement and underlying contract terms. Therefore, we consider it the most important to not only measure the wind resource as precise as possible, but also to determine the involved uncertainties by advanced and most accurate approaches. Uncertainties in that aspect are determined for the wind resource as well as the energy yield potential.

In general, uncertainties can be decreased by calibrated equipment installed in accordance to IEC61400-12-1 and to MEASNET standards. Also the height of measurement matters, as well as the amount of measurement masts spread over a projected wind farm area of interest and the measurement period. Assessing the „wind resource“ as precise as possible is the most important parameter to yield low uncertainties.

Assessing highly relevant uncertainties by application of advanced techniques and procedures

Most innovative and unique during our uncertainty assessment is that we concentrate very much on the uncertainties evolving from the quality of transition from the wind climate measured to a Weibull distribution (Weibull fit), which rarely is considered among the wind energy sector yet.

Though, the interpretation of the wind climate by an applied Weibull fit may imply huge uncertainties attached to this standardly and widely accepted procedure.

We therefore do precisely determine, if a so applied Weibull-fit actually does under- or overestimate the measured wind resource potential. This in-house developed procedure is rather unique and we do amend it by a standard uncertainty assessment in accordance to internationally accepted norms and standards, including the uncertainties originating from the wind measurement equipment, representativeness of the measurement period, long-term alignment,power curve, flow model, etc.

With lower uncertainties to higher P75, P90 and P95 values, which balance financial risks of investors

Derived from the uncertainties, the probability of exceedance with given levels of confidence P50, P75, P90 and P95 are depicted as important parameters for financial project evaluation and risk assessment. Both are governing indicators for risk management of banks and investors, which will adopt the Term Sheet for loan provision by an appropriate Equity / Debt ratio and an interest rate corresponding to appropriate risk reflection.

It is all about quantifying the uncertainty of annual energy yield predictions.

Investor decisions are commonly based on P50 and P90 (P95 or even P75 are sometimes used) levels. Better instrumentation and sensors, as well as accurate mounting and long-term data assessment, are considered for assessing the P50 value. The level of uncertainty influences the difference between the P90 and P50 level of energy generation. The lower involved uncertainties are, the smaller the difference between P50 and P90. Low uncertainties directly increase the value of a project by lower financial risks for banks and investors, leading to more attractive financing conditions granted.

English

English العربية

العربية